AI Trading Tools: Comparison and Review

This guide compares Ape AI to well‑known AI trading tools using publicly available, verifiable information. No performance claims or forward‑looking promises — just strengths, limitations, and fit.

How We Evaluated

- Focus and use case (research, alerts, automation, backtesting)

- AI capabilities (language models, pattern detection, strategy assistants)

- Data coverage and reliability

- Ease of use for non‑quants

- Compliance and disclosures

Platforms Covered (Condensed)

| Platform | Focus & Strengths | AI/Automation Summary | Notes |

|---|---|---|---|

| Ape AI | AI‑assisted research and education for retail investors | Conversational, ChatGPT‑style copilot; not a broker; no auto‑execution | Best for discovery, learning, and decision support |

| TradingView | Charting, screening, community ideas | Scripting via Pine; smart alerts; growing AI features | Excellent charts; large community |

| TrendSpider | Automated technical analysis | Auto trendlines, pattern detection, strategy testing | Strong for TA workflows |

| Trade Ideas | Real‑time scanning and AI‑driven alerts ("Holly") | Statistical models surface trade ideas | Suited to active traders |

| Capitalise.ai | Natural‑language strategy automation | Plain‑English rules that automate with brokers | Ease of automation |

Feature availability can change; verify details on each provider’s site before purchasing.

Where Ape AI Fits

- Purpose: an AI financial copilot for research and education — not a broker, and not for automated trading or order generation.

- Strengths: plain‑English analysis, idea discovery, and explanations that help you understand the “why” behind patterns or news.

- Best for: traders/investors who want faster research and clearer decision support without writing code or managing algos.

What Ape AI does not do: it does not guarantee returns, provide individualized investment advice, or execute trades. Use insights alongside your own judgment and risk controls.

Ape AI: Features & Pricing

Key features

- AI Chat and AI Analysis for research, summaries, and explanations.

- Ticker page with AI insights (per‑symbol context, catalysts, and risks).

- Brokerage integration to place orders with your preferred broker through the app (manual user‑initiated; no auto‑execution by Ape AI).

- Portfolio Tracker with AI analysis to surface risks and opportunities.

- Personalized feed with watchlist‑driven news and context.

- Style Avatars that match your trading/investing approach.

Data sources

- Benzinga for news, Unusual Whales for real‑time options flow, and FMP for real‑time price action and fundamentals.

Pricing

- $25/month.

Screenshots

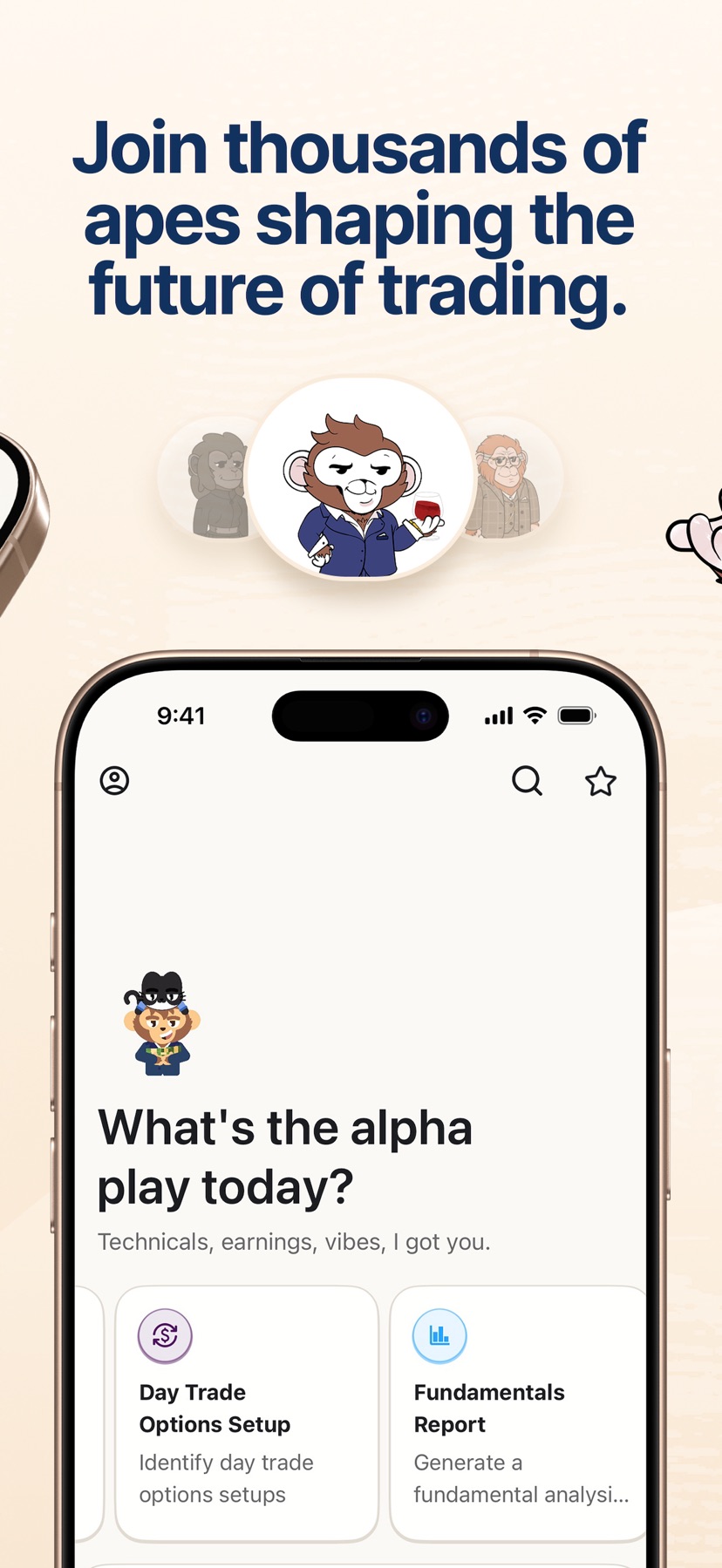

Screenshots from the Ape AI iOS app. See the full gallery on the App Store.

AI Chat and AI‑powered analysis

AI Chat and AI‑powered analysis

Ticker page with AI insights: catalysts, risks, context

Ticker page with AI insights: catalysts, risks, context

Portfolio Tracker: positions, performance, and AI flags

Portfolio Tracker: positions, performance, and AI flags

Personalized feed: news and signals based on your watchlists

Personalized feed: news and signals based on your watchlists

Brokerage integration: place orders with your broker through the app (manual)

Brokerage integration: place orders with your broker through the app (manual)

Style Avatars tailored to your trading/investing approach

Style Avatars tailored to your trading/investing approach

Choosing the Right Tool

- Newer traders: Ape AI for research and learning; TradingView for charts and watchlists.

- Technical analysis power‑users: TrendSpider for automation; complement with Ape AI for context and explanations.

- High‑frequency idea flow: Trade Ideas for real‑time scans; Ape AI to interpret and journal signals.

Workflow Example with Ape AI

- Explore a ticker or theme in Ape AI to generate a research brief. 2) Validate with charts/screeners (e.g., TradingView). 3) Define rules and risk. 4) Journal decisions and outcomes. Repeat and refine.

Disclaimer: For informational and educational purposes only. Ape AI is not a broker or investment advisor and does not support automated trading or order generation. Always verify pricing, features, and data policies with each provider.